2023 Solar Rules: Guide for New Mexico Homeowners

Updated: February 6, 2023

Solar is a newer source of renewable energy that has recently exploded in the US, due to it becoming more affordable for homeowners. With this proven source of power, the policies have progressed surrounding the tax incentives for consumers.

Recently, the rules have changed for the solar industry. At the end of 2020, congress passed a COVID relief bill in which many policies were amended. Buried in the 5,593-page bill, the federal tax credit for solar was extended for 2 more years.

Below we will review the current rules for going solar in 2021, what this means for New Mexico homeowners.

The New Rules

The 2-year extension of the federal tax credits means homeowners will have the ability to save 26% percent on their system for 2 more years. Prior, they would have till the end of 2021 to go solar with a lower 22% tax credit.

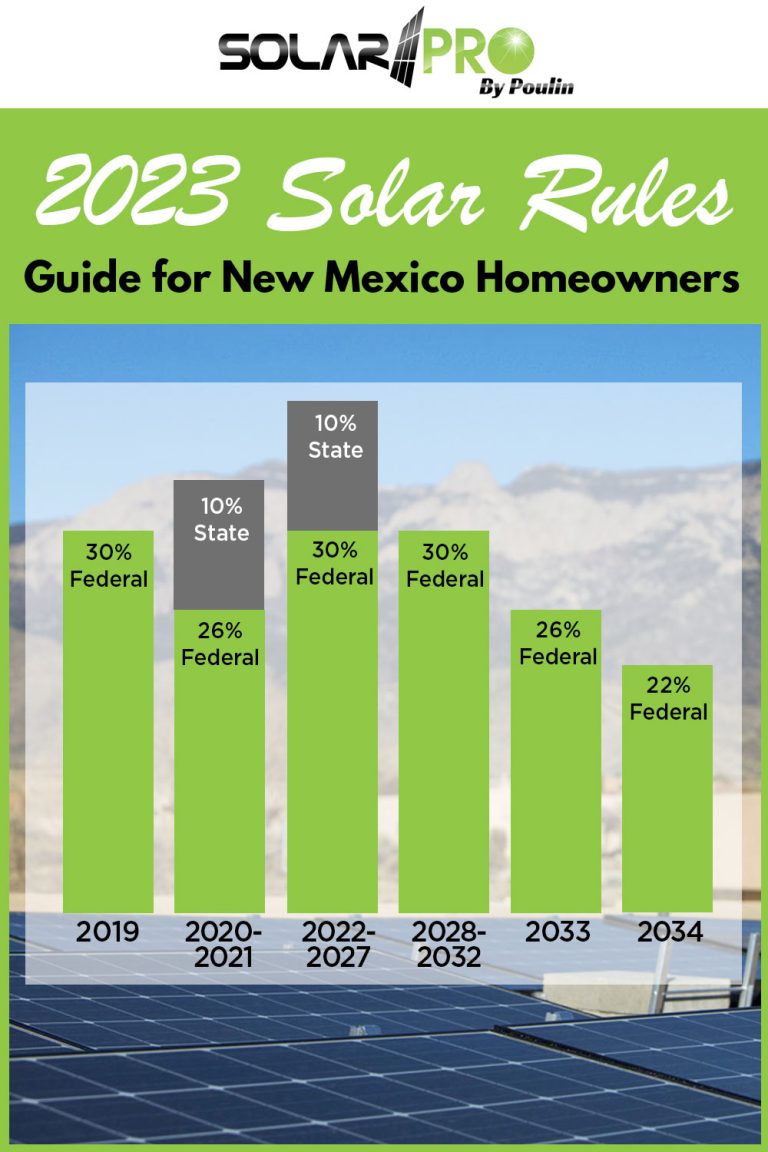

Below are the OLD rules, slated to end by 2022:

- 30% federal tax credit through 12/31/2019

- 26% federal tax credit through 12/31/2020

- 22% federal tax credit through 12/31/2021

- 10% federal tax credit moving onward—commercial jobs only

Here are the new rules with the 2-year extension:

- 26% federal tax credit through 12/31/2022

- 22% federal tax credit through 12/31/2023

- 10% federal tax credit moving onward—commercial jobs only

What Does This Mean for New Mexico Homeowners?

This is great news for homeowners in New Mexico. Alongside the federal tax credit, the state is also offering tax breaks for going solar:

- 10% State Tax Credit

- $0 State Sales Tax

- $0 Property Tax added to system’s value

If you decide to go solar in the next 2 years, you would save 36% on federal and state tax credits, plus pay ZERO sales tax.

It must be noted that in order to qualify for these savings, you must be the homeowner that buys the system. If you’re leasing solar from a company, you won’t receive the tax benefits listed above.

How Much Money Does This Actually Save You?

The average solar system in New Mexico costs $18,000. So, if you factor in your federal and state tax credits of 36%, then you’ll be paying $11,520, saving you $6,480. Plus, you’ll save $1,417.50 in sales tax (7.875% for Bernalillo county), as well as in property taxes.

The total savings for this example is $7,897.50.

Besides savings on the upfront costs of solar, you will also save money in the long run. Once your solar loan is paid off, you can start saving that money and enjoy controlling your energy costs. You will also save on the future rate increases from your electricity bill if you did not go solar.

Additionally, by going solar, you have increased the resale value of your home. To read more on this topic click here.

Overall, going solar will get you a good return on your investments in the long run.

How to get the Tax Credits

Solar savings will be reflected on your tax return. We recommend that you work with your tax professional to properly file for your tax credits to ensure you receive your savings. At this point, you can use the tax credit money towards your solar loan to reduce the cost or use it in other ways.

Here are the forms you’ll need:

- Federal tax credit: Form 5695 information

- State tax credit: Forms and instructions

Key Takeaways

- The solar tax credits have been extended for 2 years

- Homeowners can save 26% in federal tax credits through 2022, then 22% in 2023. After this, the tax credit goes away for residential solar.

- New Mexico homeowners can save 10% in state tax credits through 2027

- To receive your tax credits, file with a tax professional.

Ready to go Solar?

If you’re ready to go solar, get started with a FREE, no-obligation solar consultation with one of our Poulin Solar Pro professionals. Contact us today!